Have you caught yourself thinking “I wish I was able to save more”, “I wish I knew where all of my money was going”, or even “I wish I knew how to invest”? In this post I will be discussing 5 simple steps that everyone should be doing if they want to improve their financial situation and hopefully make some of your wishes come true.

To start let me provide you some eye-opening statistics:

According to debt.com and statista.com

- In the United States only 32% of citizens follow a budget.

- 50% of American households are living paycheck to paycheck.

- Only 39% of citizens have enough savings to cover a $1,000 emergency.

- 44% couldn’t cover a $400 emergency.

- In 2017 the personal savings rate was 2.4%.

Personally, I find these statistics alarming and you should to. After all, ‘money makes the world go round‘ and the vast majority of people are displaying a lack of financial literacy. This post is meant to help you become more aware of your personal finances and not let money run your life. Here are the 5 simple steps to improve your financial position.

#1. Budget, Budget, Budget

This may seem obvious, but numbers don’t lie and the statistic above shows us that only 1/3 of Americans are using budgets. Now in many ways a budget can seem similar to that new years resolution that you made to “go to the gym 3-5 times a week”. At the beginning its easy, you are motivated and look forward to the results. However, most people lose interest or get too busy and eventually they stop going. Budgeting is like this and it takes discipline to focus on your budget week after week, month after month.

To start budgeting your income, you must first track your expenses. You need to understand what expenses are fixed and what expenses are variable. A fixed expense is a recurring expense at a set price such as rent or loan repayment. A variable expense is an expense that can change in price, such as your grocery bill or dining out expenses. A couple awesome apps that will help you track your expenses are Mint & Clarity Money. These apps are incredibly user friendly and the best part, free. If you are old school and do not want to use these apps you can simply create a spreadsheet in excel or use a pen and paper to review your most recent bank statements to understand your expenses. Once you have an understanding of your fixed and variable expenses you will have a much better picture of where your money is going and you may be surprised.

Monthly Savings = Monthly Income – Monthly Expenses

To see what percentage you are saving per month simply divide your monthly savings by your monthly income and multiply that by 100. For example, Joe makes $3,000/ month and his fixed and variable expenses per month are $2700, leaving him $300 for savings.

300/3000= .1*100=10%

Now that you have an idea of how much you are saving per month you can review your variable expenses and see where you can reduce your spending and increase your savings. Budgeting is a strong tool that allows you to understand where your money is going and empowers you to notice any unnecessary expenditures.

#2. Save Don’t Spend

Now that you have developed a budget its time to cut back on what is unnecessary and increase your savings rate. When I first tracked my expenses, I realized that I was only saving 10% of my income and I knew if I want to be Financially Independent (FI) then I must increase my savings rate to 50% or more. After several changes, I can now say that I am saving around 65% of my income per month and I don’t feel like I am missing out at all. Let me show you how!

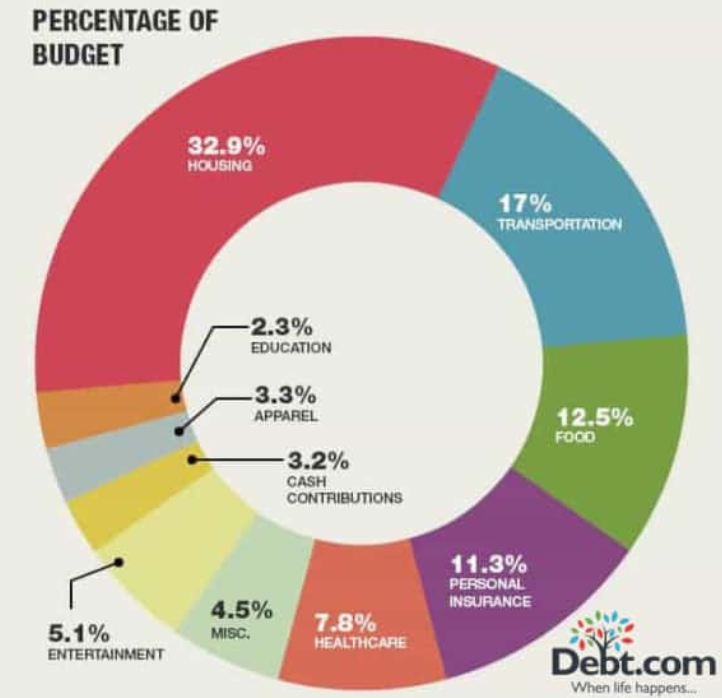

First let’s analyze this table provided by debt.com that is quantifying data published by the Bureau of Labor Statistics. This table is measuring the average person’s spending habits. As you can see, the three major expenses for the average person are housing (32.9%), transportation (17%), and food (12.5%).

Those three areas of expenses are what you want to primarily focus on in order to significantly increase your savings rate. Now I’m sure your asking yourself how can I possibly reduce any of these, so I will tell you how I did it.

From mid 2016 to mid 2017, Gina and I were renting an apartment that was sucking money out of us month after month. After spending time learning about real estate, we came to the conclusion that the next step on our path to financial freedom was to buy a house. Not just a single family, but a multifamily home. We were going to house hack. The idea is that you purchase a multifamily home, live in one unit and rent out the rest. Gina and I have reduced or housing expense to ZERO by making this move. Our tenants rent covers our monthly mortgage payment and helps us build equity in this property. This is a simple method that may seem scary, but I promise it is easier than you think.

Check out this article that dives deeper in the concept of house hacking and share your thoughts in the comment section!

During the same period of time, transportation was an expense that was really killing me. I was commuting to work 3-4 hours round trip each day which was terrible for my health and for my vehicle. I was spending tons of money on gas and oil changes each month. I knew that I had to make a change.

Therefore, when Gina and I purchased our house I made it a goal to work within a 10 mile radius of my house. Soon enough I found a job and was able to cut back my commute to just 10 minutes each way. If you want to cut back on your transportation costs then start looking into either cutting down your daily commute, local public transportation options, walking or biking to closer locations, and if you are driving a gas guzzler then think about exchanging it for a vehicle that has better mpg. Transportation can be a hard expense to cut back on but if you really want to change you will find a way.

Food is a necessity but there are cheaper ways to eat that can decrease your spending on food. For instance if you shop at Whole Foods for all your groceries then you will spend significantly more than say shopping at Market Basket. Find the cheapest grocery store in your area and do the majority of your shopping there. Next, you want to limit your spending on restaurant food. It is much cheaper and usually healthier to buy groceries and make your own food rather than getting takeout. This can be difficult but give yourself a limit for how many times you will eat out and stay disciplined to it. For example Gina and I allow ourselves to eat out once a week, we push each other to stay true to this and sometimes we don’t each out at all.

To learn more tips about how to save on food, check out this article , specifically tip #5.

Cutting costs and increasing savings can seem like a daunting task, but it is crucial and will greatly benefit your financial position.

#3. Automation

One of the simplest things to do to help manage your expenses is to put all your fixed expenses on auto pay. By doing this, you eliminate the risk of missing payments. Any missed payment can bring down your credit score which in turn can hinder future opportunities. By setting up autopay on all of your accounts you are forcing yourself to stay on top of your budget, not to mention the time this saves. Time that you can now use to earn more income, further your education, do errands, or relax.

#4.Communication

Communication is key in all relationships, and especially personal relationships. If and your significant other are looking to improve your financial health, then this is a topic that must be discussed. Financial problems can ruin a relationship, don’t let it ruin yours.

Here are a few things that Gina and I do to stay on the same page:

#1. Set shared goals

#2. Have weekly money meetings

#3. Split all expenses

Gina and I set savings goals and investment goals and every week on Sunday we take 15 minutes out of our day to discuss where we are at, how we can improve, and if we are on the right track. Gina and I enjoy splitting the cost of all our expenses because that’s what is fair. We have identical salaries and neither her nor I should be burdened to cover the bulk of expenses. That’s not to say you can’t treat your significant other and vice versa, just don’t overdo it. Money is not the reason that you want a grea relationship to end, so be open & communicate, set goals together, and get on the same page.

#5. Self-Educate

Since you are reading this then you are already taking action and working to improve your financial education. I cannot stress enough the importance of constant learning. The famous phrase “Knowledge is Power” could not be more true. If you want to be successful in any field, you must be constantly reading books, listening to podcasts, watching informative videos, and talk with people who are successful in that field. If you think you don’t have the time then you are wrong, I would recommend writing down your day on paper hour for hour. You will quickly see your open slots and be able to squeeze in your self education in a method that is easiest for you. Whenever you find yourself saying you don’t have enough time, do this practice and you’ll be able to see how much free time you really have. Its not that you don’t have time, it’s that you don’t care enough to make the time, which brings the question “How bad do you want it?” Think about it like this, if your interested in let’s say real estate, then research top real-estate podcasts and subscribe to the top 3. Now every time that you get in your car to commute to work play the podcast instead of listening to music. Take advantage of that time and improve your knowledge. With the average commute to work being 26.4 minutes, you will have more than enough time to listen to a podcast a day. During your 30-minute to 1-hour lunch break pick up a book and read. Instead of scrolling through social media at night in your bed pick up a book. The time is there you just have to make a conscious decision that you want to improve yourself.

Final Thoughts

So there it is, 5 simple steps to improve your financial situation. I really hope that

you have enjoyed this post and I wish you all the best of luck in your WICKED

finance journey