The rat race is the competitive evergoing struggle to get ahead financially and is often met with no avail. The majority of people are stuck in the rate race and fail to realize it before it is too late. In this article I’ll be discussing things that you can do to escape the rat race.

#1. Figure Out What is Important

When you are in the rat race you are constantly chasing the next best thing. In order to exit the rat race you need to decide what are the things that matter to you most. Do some self-reflecting and figure out what’s important to you and what you can live without.

Focusing on what is important to you will help to construct a clearer end goal. The rat race has taught you to chase the next best thing, but its time to break that mentality. Focus on chasing the things that are important for you.

#2. Understand Your Cash Flow

If you want to break out of the rat race then you need to buckle down and take control of your finances. Before we start anything you need to understand your personal cash flow. That is where does your income come from and where do you spend it.

Income Streams

- Job Salary

- Investments

- Side hustles

Expenses

When looking at your expenses its important to decipher what expenses are necessary and what may be luxury expenses. Take notes and write this down, knowing your luxury expenses is crucial for knowing what you can cut back on.

Now that you understand the flow of your money, you can begin looking at your opportunities. Look at your income, if you currently only have one stream of income then you need to make some changes. Now take a look at your expenses and find opportunities to save.

#3. Education

Breaking out of the rat race is going to involve some education. By reading this you are already on the right path. Continue learning more about self improvement, personal finance, and subjects that you are interested in. The more knowledge that you have the more confident that you will in turn lead to you taking action.

If you want some book recommendations check out our reading list.

#4. Start Saving More

Escaping the rat race is not going to be easy. Changing your spending habits may be challenging at first, however it is necessary.

Start by calculating your monthly savings rate, that is what you are spending every month divided by what you are earning. For example if you spend $5,000 per month and make $10,000 every month then you have a savings rate of 50%

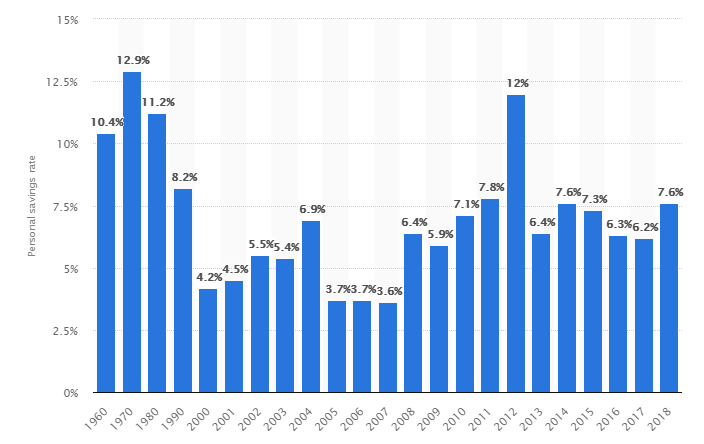

The chart below is from Statista.com, it shows the average savings rate in the US from 1960 to 2018. As you can see the average person in 2018 was only saving 7.6%.

After reviewing your monthly expenses and calculating your current savings rate you should be able to project what is the highest possible savings rate for you. It’s important to remember that this is based on your personal situation. Someone may be able to save over 50% of their income while another may not be able to save more than 10%. Everyone’s situation is different but the goal of escaping the rat race is the same.

#5. Establish an Emergency Fund

Before you begin investing your money be sure to invest in yourself. Create an emergency fund that can support you for at least 3-6 months. It’s important that the money that you put in this account never get touched unless its an emergency. Don’t start taking some off the top to help pay for something.

If you want to be financially free then you need to be prepared for anything. Having an emergency fund allows you to have protection if everything goes wrong (ex. the 2008 market crash that started the recession). After establishing an emergency fund then you want to think about investing.

#6. Invest Your Money

Make money work for you, don’t let it sit in a dusty savings account. There are many investing vehicles and strategies, and it’s important that you educate yourself on investing. Below are two vehicles that you may want to invest in. I personally think you should be maxing out all retirement accounts before starting in real estate but it depends on your own risk tolerance.

Retirement Accounts

If your employer offers a 401K retirement account program then this may be a good starting point to investing. The current investment limit to a 401K is $19,000 for 2019, working towards maxing that out may be a good goal for you. These accounts are also tax advantaged accounts, meaning that all the money that you invest into the account is in pre-taxed dollars. This decreases your take home taxable income.

Other retirement accounts to consider investing in are IRAs. There are two types, a Traditional IRA and a Roth IRA. If your employer does not offer a 401k then opening one of these accounts may be a good option. Even if they do have a 401k you can still invest in an IRA to maximize your retirement savings. The current investment limit is $6,000 for 2019. A Traditional IRA acts like a traditional 401k meaning you don’t pay taxes until you withdraw the money. Roth IRAs on the other hand tax the contributions but then you are not taxed when you need to withdraw the money. Decide if you believe you are in a high tax bracket now or if you will be in a higher tax bracket when you retire to choose which account and the taxing strategy is better for you. We will dive deeper into all retirement accounts in a separate article.

Real Estate

There are many aspects of real estate investing and it’s worth learning as much as you can and deciding what’s right for you. Some strategies of real estate investing are buy & hold, house flipping, and wholesaling. Check out biggerpockets.com for answers to any real estate question you may have.

Closing Thoughts

The rat race is a real thing however it does not need to be your reality. The steps above will help you get on the right track to financial freedom. Remember that everyone’s situation is different, be sure to educate yourself and do your research. Financial freedom is right around the corner.