Recently, I read Daniel H. Pink’s book Drive: The Surprising Truth about What Motivates Us. At a very high-level summary, the book evaluates what we are told should motivate us vs. what actually does motivate us. Then the author turns those lessons into real world actions on how we can continuously perform at our peak productivity state.

The book was a great read, not dull for a minute. I learned quite a bit from all of the various studies he sites. But one in particular stuck out more than the rest.

Pink quoted a study from Stanford University conducted by Hal Hershfield. This study showed that just by showing any given person a picture of themselves 40 years from now can increase the amount they save for retirement by more than half.

This study was done back in 2013 but is still just as relevant. The psychology behind showing someone a photograph of their older self is that basically you are showing them their future reality. Here is a direct quote from Hal about the result.

The finding: “Many people feel disconnected from the individuals they’ll be in the future and, as a result, discount rewards that would later benefit them. But brief exposure to aged images of the self can change that behavior.”

Another important thing to note, is that Hal wanted to give the subjects the most realistic looking image as possible. The more vivid the example, then the more likely it is to resonate with that subject.

Side Note: This is also a strategy used by charities in order to get people to donate. They connect you with a victim to help you relate and see the reality of the cause.

This experiment has been so pivotal that apparently some financial services now even offer clients the opportunity to receive a picture from the future.

Surprising Retirement Facts

Other than the obvious reason that saving money is always a good idea, here are some surprising facts about what the average American is doing regarding retirement savings.

All of the surprising facts below were gathered from Northwestern Mutual’s 2019 Planning & Progress study.

- 22% of American’s have less than $5,000 saved for retirement.

- 15% of American’s have no retirement savings at all.

- 56% of American’s don’t know how much they need to retire comfortably.

- 46% of American’s believe they will work past the age of 65. Out of this group, 53% of them are stating they would choose to work past that age while 47% state they would have to continue to work for monetary needs.

These are some pretty heavy facts. One thing they definitely portray is that we need to work towards spreading financial literacy and making it accessible & understandable to all.

Testing the Experiment

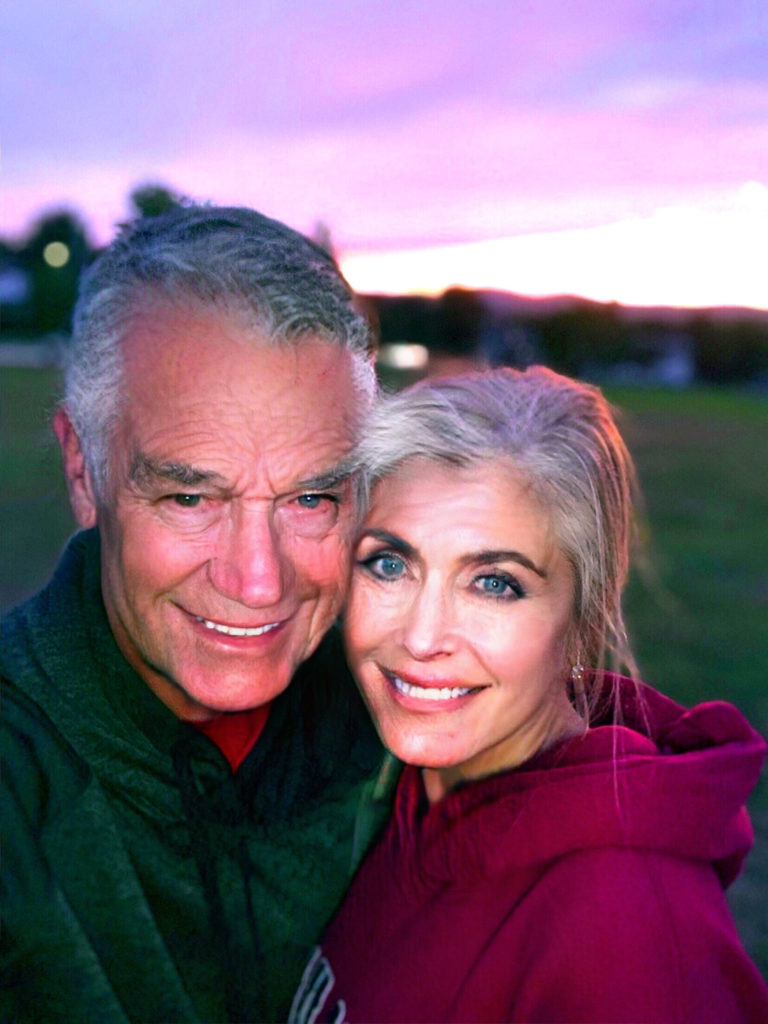

I can’t quite say that Jake and I are the perfect candidates for this study since we do already max out every retirement savings vehicle we have. However, we wanted to give it a shot to see if we even got more creative and figured out ways to save more.

That said, please see our photographic evidence below. Both Jake and I have set this picture to be our phone background and agreed to keep it there for a couple weeks.

We used FacedApp, apparently “Russia has our faces now” so that’s great. But regardless, there are dozens of apps that will age you for free. We think this experiment is more fun and light-hearted than most.

It’s an easy way to connect you with your future self and create those cognitive paths to help you think more about your future.

It’s really easy to cave for instant gratification and not think about how your actions in the present can shape your future. That said, in almost all cases (what you eat, how often you exercise, how much money you save) it is far better to consider what actions will benefit your future self.

Final Thoughts

If Warren Buffet even considered how much a haircut really cost him at age 16 when comparing pay for one vs. investing that money, then I think we all could use a heavy dose of future thinking.

Take a picture you have and throw some wrinkles on it. Even if you already think you’re saving the most you possible can for retirement, it is still a fun experiment that will at least make you think twice the next time you see wrinkle cream.

Do you have a picture of future you? Show us! Leave it in the comments, we want to see. 🙂

For more wicked reads, check out these articles!