Up until December 2018 the Military operated on a retirement system that is commonly referred to as the legacy system. The legacy system offered soldiers who completed 20 years of service a pension. If you were able to complete 20 years then this retirement system set you up nicely as you transition into civilian life. However, with the legacy system, unqualified soldiers who did not serve at least 20 years walked away with nothing.

The new retirement system known as the blended retirement system (BRS) combines characteristics of the legacy system and a 401k.

With the BRS soldiers who serve at least 20 years in the military will receive a pension. However, their monthly pension payment is now 20% less than what used to be paid out under the legacy system.

The benefit of the BRS is it allows you to contribute to a Thrift Savings Plan (TSP) throughout your career. A TSP is similar to a 401k and allows service members to contribute to a tax advantaged retirement account that they can’t withdrawal from until 59 1/2 years of age. This allows soldiers who don’t serve at least 20 years to walk away with something compared to nothing in the legacy system.

Another great benefit to the BRS is that service members receive an automatic 1% DoD match on every paycheck. The DoD will also match up to an additional 4% of the soldiers monthly base pay.

In my opinion, the blended retirement system is an awesome upgrade to military benefits. The majority of soldiers don’t stay in for 20 years and this system allows them to invest in their future. The best way to take advantage of this benefit is to contribute at least 5% of your base pay to your TSP account. This will allow you to get the full DoD 5% match which is literally free money! If you’re not investing at least 5% then you are effectively leaving money on the table.

Getting Started

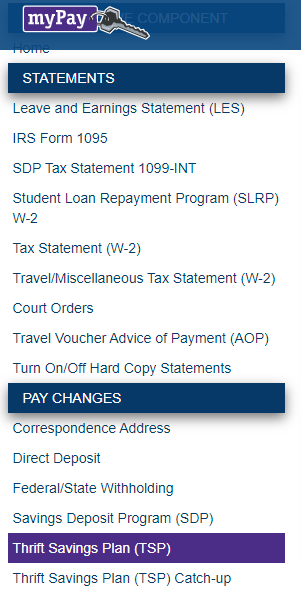

Getting set up with the BRS is super easy and can be completed in three steps. The first step is to head over to the mypay website. After you’ve logged in you’ll want to look on the left side banner towards the bottom. Under the Pay Changes banner you will find an option for Thrift Savings Plan (see the picture below). After you’ve selected that link you will be redirected to a page that allows you to set your TSP contribution rates. As I mentioned before you should contribute at least 5% to your TSP account in order to reap the full benefits of the DoD match.

The next step is to log into your TSP.gov account and research the investment options. If this is your first time visiting this page then you’ll have to create an account. Once you’re logged in then you can select “Investment Funds” from the top menu and you will find information on every type of fund that is offered. Here is a quick breakdown of your options:

L Fund

The L fund is also known as the lifecycle fund and is a great option for the “lazy investor”. This fund takes your age and retirement date into consideration and creates an asset allocation based on this. If you have a long time until retirement then this fund will invest your funds in investments that are higher risk but offer higher reward. If you are closer to retirement this fund will create a more risk averse portfolio. This fund is a great option if you don’t want to deal with creating your own asset allocation.

G Fund

The G fund is made up of government securities and is a low risk low return investment fund. The biggest pro to the G fund is that you will never lose any of the money you invest because your invested in government backed securities. The con with investing in the G fund is that you lose out on higher potential returns from alternative investments. Allocating a portion of your portfolio to the G fund can be a great way to reduce the overall risk level of your investment portfolio.

F Fund

The F fund is the fixed income investment fund and is designed to match the performance of the Bloomberg Barclays U.S. aggregate bond index. Compared to the G fund the F fund is slightly higher risk but offers the potential for higher returns. The F fund is another great low risk investment option to mix into your asset allocation.

C Fund

The C fund is the common stock index investment fund and is designed to match the performance of the S&P 500. In comparison to the G & F funds, the C Fund offers much higher return but also exposes you to more risk.

S Fund

The S fund is the small cap stock index fund and is designed to match the Dow Jones total stock market index fund. This index fund includes small/mid sized companies that are not included in the S&P 500. The S fund is another great way to diversify portfolio.

I Fund

Last but not least we have the I fund also known as the international stock index investment fund. Similar to the C & S funds, the I fund is designed to match the performance of the MSCI EAFE. This fund allows you to invest in international companies that aren’t found in the S or C fund. One of the risks that this fund is exposed to is currency risk which means that the value of your portfolio can be affected by the value of the U.S. dollar.

These are the 6 investment funds that you can invest your TSP contributions into. As you can see, these options are all different and have different levels of risk and return potential. Be sure to do your research and invest in the funds that are right for you.

After you’ve completed your research the final step is to finalize your asset allocation. In your TSP account, you will be able to select how much of your contributions you want invested in each fund. For example you can invest 100% of your contributions into one fund or divy it up across funds such as 50% into the C fund, 40% into the G fund and 10% into the I fund.

After Set Up

Now that you’ve gotten through the painful part, you can now sit back and relax. Your contributions will now seamlessly be deducted from your paycheck and invested according to your allocations. If you ever want to increase or decrease your contribution rate then simply log into mypay and go through step 1 mentioned previously.

Closing Thoughts

The new blended retirement system now offers soldiers at all levels an opportunity to invest in their future. The DoD contribution match is a benefit that you should absolutely take full control of. Contributing at least 5% will get you the full DoD match of 5% which will bring your total invested amount to 10% of your base pay (but the beauty of it is, is that only 5% came out of your paycheck!).

Your future self is seriously going to thank you for investing in your future. Be sure to do your research and select the asset allocation that suits you best. If you have any questions at all about the TSP program, the set up process, or investment funds then please feel free to ask below in the comment section or check out tsp.gov.

If you’re looking for some more wicked reads then be sure to check these out: