We are so close to entering a new decade! Man – how time flies. What were you doing at the beginning of this decade?

In 2010, I was a mere 14 years old. Just having entered high school, having no idea what was ahead of me.

I saw a picture on instagram, posted by Gary Vaynerchuk, showing him at the beginning of the decade vs. now. At the beginning of the decade, he was working at his parents liquor store, trying to do the best he could. Now, he is a world-renowned entrepreneur and worth over $100 Million. That is quite a transformation.

This comparison really made me think about how much can really happen in a decade. It might seem like a somewhat small measure of time when we use one short 6 letter word to describe it, but you can accomplish an incredible amount in that span. Just look at Gary Vaynerchuck.

You’re probably thinking something along the lines of “Ok Gina, what the heck. Get to the point of this article”. Well, every good story came to fruition through some inspiration right?

Seeing Gary Vaynerchuk’s decade transformation reminded me of the concept of working backwards. One instance when you would work backwards is when you are creating a business strategy. Experts often say, “begin with the end in mind”. Who do you want using your product? Why should they buy your product over the hundreds of other similar products? The questions continue until you outline an entire path forward with your ideal final outcome.

Essentially you have made yourself a “follow the yellow brick road” type scenario where if you follow the general steps in the plan, your end result will be what you wished it to be.

So, why can’t we do that with everything else in our lives… perhaps even a budget? In this previous article, I briefly introduced this idea but in today’s article we will walk through the entire process.

The Backwards Budget

The backward budget uses that same exact strategy of beginning with the end in mind. Following the steps below while being financially disciplined, will allow you to correct poor spending habits, and accomplish planned financial goals. Here are the steps:

#1. Outline Your Goals

What are they? How much do they cost? When do you want to meet them by? You can outline as many goals as you want, just make sure you are measuring them by time and dollar amount.

For example, let’s say you have two major goals. The first is to have $500,000 saved in 10 years and the second is to buy a $100,000 house in cash in 5 years.

#2. Do The Math

How much do you have to save every year to meet that goal? How about every month? Every week? Every day? Breaking down your savings goals into daily amounts can really help your spending habits.

We like to tie everything to percents to keep track of our savings rate. This is done by dividing the amount you’re saving by the total income you are bringing in. By seeing the actual percent of your income saved, you are creating a metric that can be used for comparison. Also, if you are trying to get your spending in order, then this can be an eye-opener and help motivate you to stop swiping your credit card.

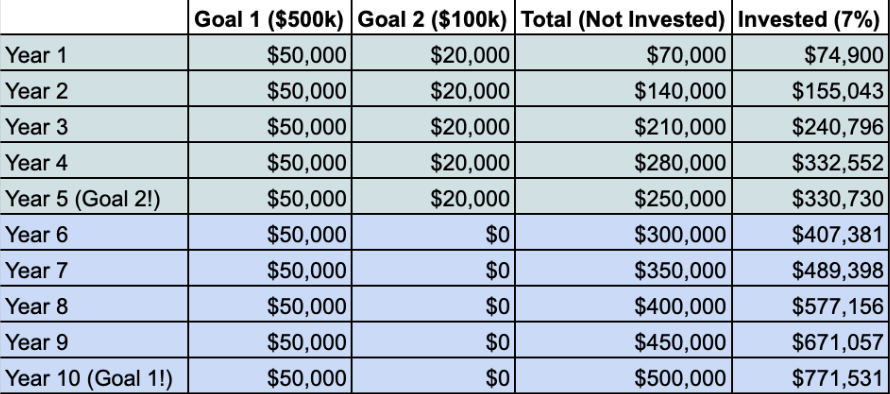

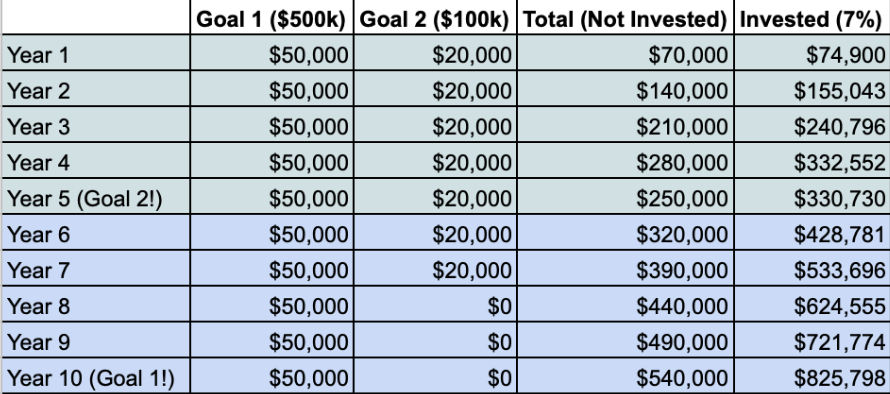

Working off the example above, if you want to save $500,000 in 10 years you will have to save $50,000 a year. And if you want to have $100,000 in cash to buy a house in 5 years you will have to save $20,000 a year. So keeping both goals in mind, you will have to save $70,000 a year to meet both of them.

If your salary is $100,000 per year after taxes, you would have to save over 70% of your salary, or $70,000 each year. What this shows is that you will have to live off of $30,000/ year unless you get a side hustle and or get a raise at your current employer.

The graph above is showing us the amount saved towards these two major goals over the lifespan of each goal. It compares investing each goal in the market and assumes a 7% return vs. just keeping it in your savings account. In year 5, $100,000 was taken out of both columns in order to pay for the home purchase.

The 5 year goal of $100,000 in cash for a house is met in year 2 for each scenario which was obvious. However, if you look at the 10 year goal of $500,000… that was actually made in year 8! It honestly could have been made in year 7 if the $20,000 towards goal 2 was still stashed away even after purchasing the home. See the table below for an example.

*Note: Inflation was not taken into consideration for comparison purposes.

#3. Pay yourself first

Ok. So now that we see and understand how this works, it is time to actually be disciplined enough to meet these goals.

The easiest and best way to do this is to completely automate the savings process.

You will have to breakdown your yearly savings goals into either weekly, bi-weekly or monthly. This is dependent on how often your paycheck hits your bank account.

Then set up an automatic transfer from your bank account to your savings account every single payday. Or if you want to invest the money, you can set up an automatic transfer from your bank account to whichever investment vehicle you are using. Check out this article for what type of investment vehicle you should be using.

By automating the process, you are not only saving yourself time but you are also eliminating the chance of you spending that money.

The entire point of the Backward Budget is deciding how much you want to be saving in order to hit your goals. The best possible way to do that is to take the amount you want to save off of the top of your paycheck.

If you take the savings you want off the top of the paycheck, then what you have left over is what you have to live off of. This is for bills, groceries, entertainment, etc.

#4. Repeat

It really is that simple. This is not a line by line budget. It is literally something that me, an incredibly lazy person, uses to save 70% of their income. If I can do it, you definitely can.

This should take you less than 5 minutes a week, if that. The only things to check up on include, making sure your paycheck comes and that your money is invested appropriately.

If you’re like us and like a little bit of an extra challenge, try to amp up your savings rate a percent or two every couple months. Basically, this is ensuring you aren’t getting stagnant. We like to keep you on your toes! 🙂

Final Thoughts

Anyone can do this budget. It is quite literally a set it and forget it method. Once you go through the process of setting your goals and figuring out how much you need to save to get there, then all you have to do is automate. Then BOOM! You’ll be meeting your goals in no time at all.

That said, thank you for reading and I hope you found value in this budgeting style – we love it! 🙂

What were you doing at the beginning of the decade?

What will you be doing at the end of this next decade?

For more wicked reads, check out these articles!