Happy Thursday! Some pretty exciting things are happening over here on the blog. The most exciting of which is showcased below. We are adding a new “page” to our blog called Ask Us Anything. On this page, as one would guess, you can quite literally ask us anything.

The inspiration for this page? YOU!

We have had a couple readers now email us asking for some guidance on their general financial well-being. Which made us think… why not use this as a learning opportunity for everyone?

So with one questioner’s permission, we bring to you our first ever “Ask Us Anything” post!!

Side note: We will answer the ask us anything posts on a volume based frequency.. the more questions we get, then the more posts we will share 🙂

That said, lets get started!

… but one last thing. Below outlines what I would do if I were in this reader’s shoes. This is not investment advice and I am not a lawyer, certified financial planner or any sort of professional in those fields. Please take everything below with a grain of salt.

The Case

Readers Alias: Dude from Boston

Dude from Boston’s location: ….Boston, MA

General Situation: Dude from Boston is a renter with no plan to buy in the future. He works in the Health Care industry making just over $100k a year. He is single and ready to mingle. He enjoys traveling and hopes to do more of it once he reaches FI. He wants to know how long it would take him to be financially independent.

Age: 29

Goal: Financial Independence 🙂

Initial Thoughts:

Narrow down your goal. Financial independence is great, but what does that really mean to you? Maybe you have narrowed it down and we just aren’t aware but financial independence can be interpreted in many ways. For the sake of this example, we are going to assume it means that you have enough saved in investments where you can sustain yourself financially for the rest of your life.

Also, it is really important to know your why. Why do you want to be financially independent? Your why should be strong enough to motivate you through your journey.

Some examples:

- I want to be financially independent to do more meaningful work for a good cause like fighting world hunger

- I want to be financially independent to travel the world and find the world’s best cannoli

- I want to be financially independent to follow my dream of being a stand-up comedian

The stronger your why and the more detailed it is, the better. Jake and I both revisit our why’s somewhat frequently, they give us the motivation and keep us on course when we are feeling a bit discouraged.

Number Time

The numbers provided below are not all exacts. Some were estimated and some came directly from monthly statements.

Income

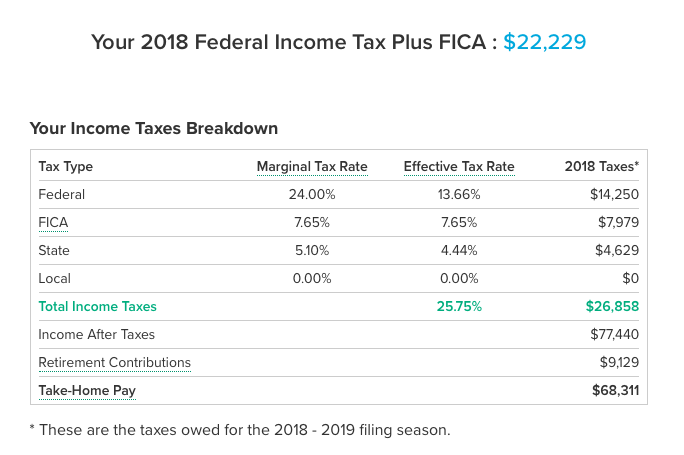

| Gross Income | $104,298.00 |

| Net Income (After Taxes): | $77,440.00 |

| Take-Home Pay (After Retirement & HSA Contributions): | $68,311.06 |

We backed out your Net Income and Take Home Pay since you gave us all the other information. For the tax situation, I just googled tax calculator and used this one from SmartAsset (screenshot below) seemed to do the job the best and it just so happened to also calculate take-home pay as well.

Straight away, no issues yet. A strong income that should make it easier to save for FI.

Annual Contributions

| Annual Contributions | |

| 401k Contribution (3%) | $3,128.94 |

| 401k Match (3%) | $3,128.94 |

| Traditional IRA | $6,000.00 |

| Brokerage Account | $2,000.00 |

| Total | $14,257.88 |

This looks great. Really impressed with how much your able to put away each year, especially love that you are maxing out your Roth IRA. Also, very glad to see that you are taking complete advantage of the 3% 401k match your employer offers. A couple questions I would pose are:

- Does your employer offer an HSA plan? It might be beneficial since HSA’s are triple threats when it comes to taxes (invested with pre-tax dollars, grow tax free and qualified withdrawals are tax free).

- Would you consider shifting the $2k you put in your brokerage account into your 401k? This would offer more tax benefits in the long run. Of course, if you are using this to day trade then that’s a different story. If you are just testing out the waters of investing or investing index funds in your brokerage, then I think moving it over would be beneficial.

- What is your investment allocation for each of the accounts? At 29, you can afford to be risky however you don’t want to be overly invested in one asset class. I would recommend taking this risk tolerance quiz and allocating your investments accordingly. Another good rule of thumb is to take your age and subtract it from 110. That is the amount you should be invested in equities and the remaining percentage should be your bond allocation. For someone who prefers a bit more risk, swap 110 out for 120. For someone who is a bit more conservative, use 100 instead of 110.

Expense Breakdown

| Monthly Expenses | |

| Rent | $1,475.00 |

| Groceries | $400.00 |

| Utilities | $90.00 |

| Entertainment | $600.00 |

| Car Insurance | $85.00 |

| Car Loan | $200.00 |

| Student Debt | $150.00 |

| Credit Card Debt | $25.00 |

| Phone bill | $50.00 |

| Total | $3,075.00 |

Eeek. Jake and I are spoiled with house hacking, seeing the high dollars spent in rent expense is just reassurance of that.

Anyways, without knowing much about your spending habits, I would challenge you to budget yourself and try to spend less. Especially since your goal is financial freedom, you want your expense to be comfortable of course but as low as your comfort level allows. Your entertainment bill is more expensive than your groceries, it is tough in a city where alcoholic beverages cost $12+ but try to minimize the cost where you can.

Also, the credit card debt expense here scares me. Without looking at your liabilities yet, only paying $25 looks like the minimum payment which is never a good idea, especially if you have the extra cash flow to throw more money towards it.

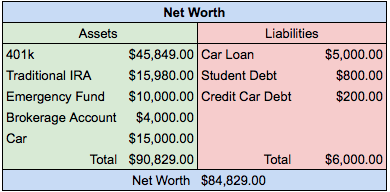

Investments/Savings Balances:

| Balances | |

| 401k | $45,849.00 |

| Traditional IRA | $15,980.00 |

| Emergency Fund | $10,000.00 |

| Brokerage Account | $4,000.00 |

| Total | $75,829.00 |

My thoughts:

- $10,000 (emergency fund) / $3,075 (monthly expenses) = ~3.25 months worth of living expenses saved up in case of catastrophe. This is a great start. I would work towards boosting that up to 6 months. If you end up lowering your monthly expenses, then this will positively impact your emergency fund as you need less money to live on a month to month basis. Therefore, you can live off less and the $10k you have saved would last you longer than ~3.25 months.

- Where is your emergency fund currently? Try to make sure it is at a bank that is giving you a higher interest rate. Ally gives you 2.1% at the moment, which beats the average bank which is about 0.06%.

Liabilities

| Liabilities | |

| Car Loan | $5,000.00 |

| Student Debt | $800.00 |

| Credit Car Debt | $200.00 |

| Total | $6,000.00 |

Ah. There it is. That nasty little credit card debt line. My biggest question is, why not just pay it off in full? If it is really only $200, then why not sacrifice $200 in your monthly expenses to ensure this gets paid? You could direct some of the money that is going towards your brokerage account to this instead, although I would rather see those expenses go down.

I would argue the same for student debt. Why not just pay it in full and sacrifice in your budget? This one isn’t as dire since I am assuming (hoping/praying) that you don’t have as high of an interest rate on your student debt as you do the credit card debt.

The car loan is tricky. How frugal do you want to be? Personally, I wouldn’t take out a loan for a depreciating asset. I would try to sell the car and use that money to pay off the remainder of the loan, buy a cheaper but just as capable car and invest the rest.

That said, if you want the luxury of a new car then by all means keep it, but I wouldn’t suggest doing the same thing again and it might also be wise to make cuts in your budget to cover this monthly loan expense. That way more of your money is going towards your end goal of financial independence.

A Different Look

Your net worth is almost $85k! This will increase as you pay down debt and as your continue your strong investing pattern.

I included a guesstimate on your cars actual value if you sold it today, obviously that could be above or below the actual amount.

Comparing actual net worth amounts to what they should be by age is very hard in my opinion. Not hard in the comparison aspect, that is easy. But hard in the sense that you have a far different goal than the average American saving the average amount. So for this case study, I will not include any comparisons for net worth – it also doesn’t really add any tangible value so I render it useless.

Financial Independence

Alright, so let’s take a deeper dive into your journey to FI.

Your take-home pay after retirement savings is: $68,311.06 minus the $2,000 you put towards your brokerage accounts, leaves you with $66,311.06 to live off of for the year.

68,311.06 – 2,000 = 66,311.06

take home pay – brokerage account funding = income for year

Your monthly expenses (without any cuts) total to $3,075.00. That number multiplied by 12 months in the year gives us $36,900.00, also known as your yearly need. Your monthly expenses are going to decrease when you pay off debt, so keep that in mind as well. This is the amount you will assume you need annually when you are FI.

3,075 * 12 = 36,900

monthly expenses * 12 months = yearly income need

That means there is a pretty big gap between what you are bringing home after retirement savings and funding your brokerage account vs. your total annual expense cost.

66,311.06 – 36,900 = 29,411.06

income for year – yearly income need = left over amount from income for year

Because of this gap, I think it is safe to say you could definitely be maxing out your 401k (current 2019 limits are $19,000). So even if you were to max out your 401k, you would still have extra dollars to put towards other investments (i.e. HSA, real estate, brokerage account).

29,411.06 – 19,000 = 10,411.06

left over income for year – 2019 401k contribution limit = total left over to go towards other investments

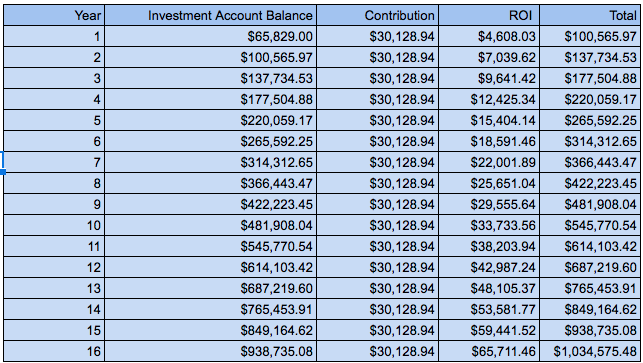

So let’s take those assumptions and pretend you’ve utilized them and are on track for FI. Let’s look at about how long that would take you if none of the numbers listed above increased or decreased. Also, we used 7% return from the market for conservatism.

If you don’t adjust your monthly expenses so you need $36,900 a year to live, you want to multiply that by 25 to see what you would need to reach financial independence. The 25 multiplier comes from financial planners trying to factor in longevity risk or the risk that you will run out of money. Learn more about this and the 4% rule here.

$36,900 * 25 = $922,500

Annual need * 25 (4% rule for retirement) = Your Financial Independence Number

Note that this is just looking at invested assets. I did not include your emergency fund in this.

*Note that 401k contributions are now $19,000 + employer match for this assumption. No further assumptions made on how the remaining $10,411.06 would be invested.

So in 16 years, you would have just over the amount you need to retire early. This is really quick especially when you compare it to the average 40+ years that most people are saving for.

Some ways to quicken the timeline of this would include:

- Reducing your monthly expenses

- Increasing your salaried income

- Start a side hustle to bring in more income

- Invest in an asset with monthly cash flow (i.e. real estate) which minimizes your monthly need and therefore lowers your annual need, so you don’t have to save up as much money.

More Questions

I didn’t see anything on health or life insurance. What do your current policies look like?This will affect your monthly expenses.

If you really want to cut down expenses, would you consider house hacking? This could potentially eliminate all of your housing bills (rent, utilities, wifi, etc). However, this would require an initial investment but with FHA loans that can be minimized.

Alternatively, you could try moving to smaller/cheaper apartment if available.

Have you ever tried using Mint as a budgeting tool? It really helped us when we were getting started.

Do you plan to still work once you reach FI? Any passion projects or random side hustles would help lower the amount your withdrawing and therefore you could potentially need even less to be financially independent.

Final Thoughts

Overall, great job Dude from Boston! You are well on your way to financial independence. With some minor adjustments, you can seriously quicken the process. If there was any other information you want to cover or include, make sure to let us know. Also, THANK YOU SO MUCH for being our first ever case, we greatly appreciate your support and willingness to share your story! 🙂

How many years until you reach your financial independence number? Let me know in the comments section!

Exploring the Benefits of Artificial Intelligence in Real Estate Investing

Life Planning 101: Tips for Beginners at Any Age

Sports Officiating as a Side Hustle

Moving Out of Your Parent’s House? Make the Most of It by Taking Care of Your Finances

Here Is Some Good News Guaranteed To Make You Smile