With the new year about to kick off it’s time to buckle down and start crushing your finances. These 7 frugal finance tips will help you save more, spend less, and earn more. But, before we jump into the fun stuff it’s time to take a hard look in the mirror. I want you to develop an understanding of wehre you currently are financially and where you want to be. Set SMART financial goals and determine what steps you need to take to get there. These 7 frugal finance tips will help you reach your financial goals, so without further ado let’s dive in.

The Backwards Budget

If you’re looking for the lazy man’s budget then the Backwards Budget is definitely for you. In short, this budget strategy pays you first and moves the rest to savings/investing. For example, if you’re goal is to save 50% of your income, then you would setup an automatic transfer that occurs on your pay day and moves 50% of your income into a savings account.

The remaining 50% from your paycheck is now yours to live off of for that period. It’s much more tempting to overspend when your entire paycheck is in one place. With the Backwards Budget you are forced to adapt and reduce your spending habits so they fit your smaller budget.

To learn more about this strategy check out: The Backwards Budget: How We Save 70% Of Our Income

Earn Cash Back While Shopping

Did you know that you can earn cash back on the majority of your purchases? Whether it be online or in-person, shopping is something that everyone does. We use Ebates for online shopping and Ibotta for grocery shopping and save hundreds over the year.

Ebates, now rebranded to Rakuten, is an online shopping rewards company that has over 10 million members. So, how does it work? Basically, stores pay Ebates a commission for sending members to their online stores. Ebates then splits that commision with the member making a purchase.

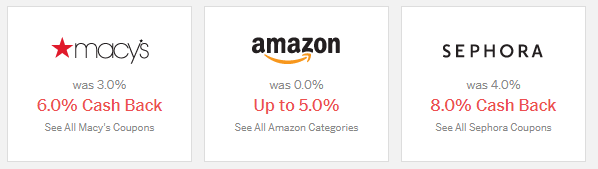

For example, the picture below shows current cash back offers through Ebates. All you have to do is sign up for a free ebates membership and then either install their plugin or visit the Ebates website and select the store you want to shop at.

In this case if you selected Amazon then you would receive 5% cash back on all qualified purchases, so if you spend $100 at Amazon then Ebates would reward you with $5.

If your already planning on buying something online then you should definitely go through Ebates and earn cash back completely hassle free.

Ibotta is another tool that we use to earn cashback. Ibotta is similar to Ebates in many ways but you can use it for more than online shopping. For instance, with Ibotta you can earn cashback while shopping in-person for groceries, clothes, beer, pharmaceuticals, beauty products, and restaurants/bars.

Gina and I use Ibotta for our grocery store trips and have earned a decent amount in cashback. These apps allow you to save money while shopping and are super easy to use. If your shopping and not using one of these apps then your doing it wrong.

If your interested in Ibotta you can sign up here for FREE!

Downsize/House Hack

Did you know that the average housing expense is around 30% of an individual’s income? That’s seriously a lot of money going to housing. If you are currently living in an overly large home/apartment or live in an overly expensive neighborhood then you may want to consider downsizing or relocating to a cheaper area.

We often get comfortable where we live and create emotional attachments so downsizing or relocating can be quite difficult. However, the impact that it will have on your savings may alter your thought process.

Another way to reduce your housing expenses is through house hacking. Gina and I have managed to completely eliminate our housing expense with house hacking. We purchased a 4-family home and rent out three of the units. The rent that we collect covers the cost of our mortgage and some, which means we are actually getting paid to live in our house! Not a bad deal if you ask me. 😄

If you want to learn more about house hacking you can find our complete series here. 😄

Public Transportation

Public transportation can be a great money saver for those of us with long commutes or those who live in a city. Using public transportation is a great way to be frugal. The overall cost for a train or bus ticket is fairly cheap plus you reduce the overall wear and tear on your personal vehicle, you don’t have to drive in traffic, and you can do something productive during that travel time.

If public transportation is available to you then you should definitely take advantage of it. Another great option to save on commuting is biking. If your destination is reasonably close then biking is a great option. Once you own a bicycle, the cost of transportation is free, plus you get exercise while biking.🚴

Driving a car daily can be quite expensive between gas, repairs, and monthly payments. Finding cheaper methods of transportation can have more of an impact on your finances than you can imagine.

Meal Prep

Fun fact, meal prepping isn’t only for bodybuilders. In all seriousness, meal prepping will save you both time and money. We’ve found that when we meal prep we are way less likely to spend money on take out. We also eat better and spend less time during the week cooking food.

Ordering take out or going out for food is a quick way to rack up your food expenses. Meal prepping is the frugal finance tip that you need to do in 2020. This will allow you to decrease your food expense, save time during the week, and force you to eat better (if you choose).

DIY

2019 has been filled with DIY projects from renovating our kitchen, to painting our apartment, to repairing our washer. We all have something that needs to be fixed or something that we want to update and many times we opt to pay someone else to complete these services.

Paying someone else isn’t always a bad thing. If a project is above your expertise or learning ability then it’s worth calling a professional. However, if you are able to complete the project yourself then you can save big time.

I’ll be the first to tell you that I’m not a handyman, but I am able to watch a few youtube videos and figure it out. Youtube University is my go to for all my DIY projects. More often than not, someone has had the same problem and made a ‘how to’ video on that topic.

In 2020, push yourself to do more projects yourself, you may be amazed at what you’re capable of and how much you’ll save.

Side Hustle

If you don’t already have a side hustle then 2020 is the year to start one. A side hustle is something that you do on the side to make extra money.

One of the side hustles that has kept me busy lately is refereeing basketball. All of my games are on Saturdays or Sundays and I generally do 2-4 games per day at $40 per game which usually last an hour or so. In one month, I can make between $600-$1300 for 16-32 games/hours worked.

Side hustles are a great way to make extra money, here are some other side hustle ideas:

For even more ideas check out this article: 17 Must Try Side Hustles

Closing Thoughts

It’s time to forget about the past and look forward to the new year. This is going to be your year! This is the year that you are going to take control of your finances! These 7 frugal finance tips will assist you in accomplishing all of your finance goals.

If you know someone that could benefit from reading this article then please share it with them. 😄 If you’re looking for more wicked reads then check out these articles: